The Buzz on Paul B Insurance Medicare Explained

Table of Contents5 Simple Techniques For Paul B Insurance Medicare ExplainedThe Facts About Paul B Insurance Medicare Explained UncoveredThe Ultimate Guide To Paul B Insurance Medicare ExplainedThe smart Trick of Paul B Insurance Medicare Explained That Nobody is Talking AboutUnknown Facts About Paul B Insurance Medicare ExplainedThe smart Trick of Paul B Insurance Medicare Explained That Nobody is Discussing

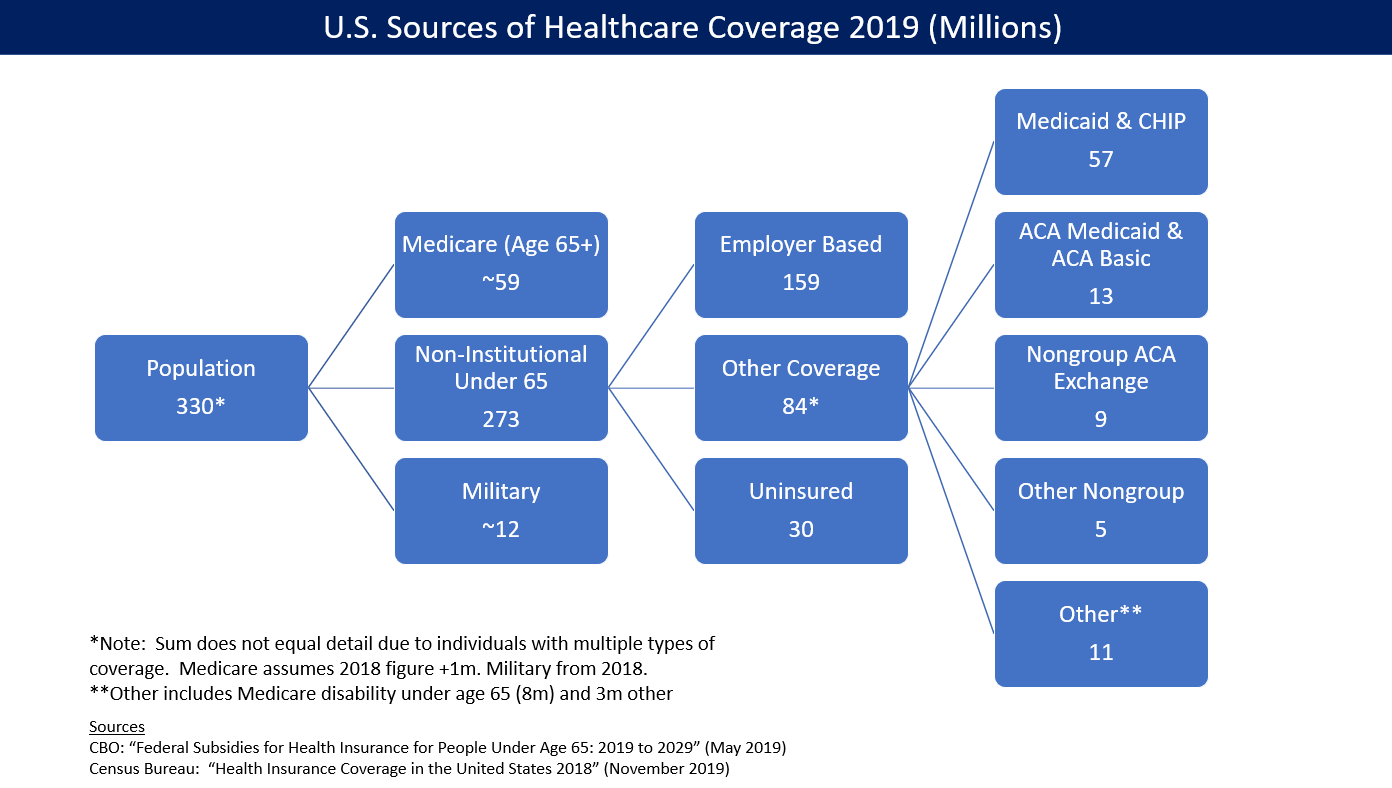

Depending on your revenue, you as well as your household might get approved for totally free or low-cost medical insurance with the Kid's Medical insurance Program (CHIP)or Medicaid. Enrollment in these programs is open year-round. Medical Help offers comprehensive insurance coverage and also is there for people who drop on difficult times and need assistance. The most effective way to make an application for Clinical Help is the Commonwealth's COMPASS tool.If you are entitled to choose COBRA protection, you have to be given an election duration any time for as much as 60 days after the nationwide emergency affirmation is raised for COVID-19 (paul b insurance medicare explained). If you choose to proceed your COBRA health and wellness insurance policy plan at your very own expenditure, you will additionally pay the part of the premium your former company paid on your part.

, and also platinum. Bronze plans have the least protection, and also platinum plans have the many.

Paul B Insurance Medicare Explained Fundamentals Explained

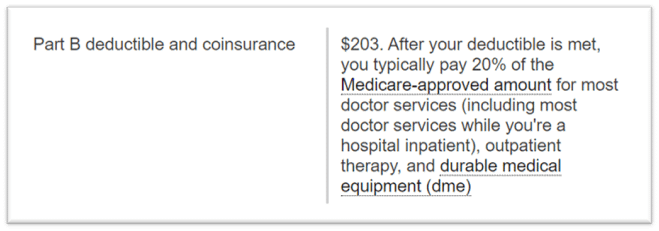

Exactly how are the plans various? In enhancement, deductibles-- the amount you pay before your strategy picks up 100% of your wellness treatment prices-- differ according to strategy, normally with the least expensive carrying the highest possible deductible.

Catastrophic plans must likewise cover the initial 3 main care sees and preventative look after totally free, also if you have actually not yet fulfilled your deductible. You will certainly likewise see insurance brand names connected with the care degrees. Some large national brand names include Aetna, Blue Cross Blue Shield, Cigna, Humana, Kaiser, and also United.

Being familiar with the strategy kinds can help you choose one to fit your spending plan and satisfy your healthcare demands. To learn the specifics concerning a brand's specific health insurance, check out its recap of benefits. An HMO provides all health and wellness services through a network of doctor as well as centers.

What medical professionals you can see. Any type of in your HMO's network. If you see a medical professional that is not in the network, you'll may have to pay the full expense on your own. Emergency services at an out-of-network hospital should be covered at in-network prices, yet non-participating doctors who treat you in the healthcare facility can bill you.

Paul B Insurance Medicare Explained Fundamentals Explained

Insurance deductible: Your plan may require you to pay the amount prior to it covers treatment other than for precautionary care. A copay is a flat fee, such as $15, that you pay when you obtain care.

.png)

Documents involved. There are no claim develops to load out. With a PPO, you may have: A moderate amount of flexibility to pick your healthcare carriers-- greater than an HMO; you do not have to get a referral from a medical care physician to see a professional. Greater out-of-pocket prices if you see out-of-network medical professionals read what he said vs.

Other costs: If your out-of-network doctor charges greater than others in the location do, you might need to pay the equilibrium after your insurance policy pays its share. Documentation entailed. There's little to no documentation with a PPO if you see an in-network physician. If visit this page you utilize an out-of-network supplier, you'll need to pay the company.

With an EPO, you may have: A moderate amount of liberty to choose your wellness care companies-- more than an HMO; you do not have to get a referral from a health care medical professional to see a specialist. No coverage for out-of-network carriers; if you see a provider that is not in your strategy's network aside from in an emergency you will certainly need to pay the full cost on your own.

How Paul B Insurance Medicare Explained can Save You Time, Stress, and Money.

Premium: This is the expense you pay each month for insurance. Copay or coinsurance: A copay is a flat charge, such as $15, that you pay when you obtain treatment.

Costs: This is the expense you pay each month for insurance. Insurance deductible: Your plan might require you to pay the quantity of a deductible prior to it covers care beyond preventive services.

Copayments and coinsurance are greater when you make use of an out-of-network physician. Paperwork included. If you go out-of-network, you need to pay your medical costs. You send an insurance claim to your POS strategy to pay you back. If you are under the age of 30 you can purchase a tragic health insurance plan.

Facts About Paul B Insurance Medicare Explained Uncovered

Various other expenses: If your out-of-network physician bills even more than others in the location do, you might have to pay the equilibrium advice after your insurance policy pays its share. If you make use of an out-of-network provider, you'll have to pay the company.

With an EPO, you might have: A modest quantity of liberty to choose your healthcare service providers-- greater than an HMO; you do not have to obtain a reference from a key treatment physician to see a specialist. No coverage for out-of-network companies; if you see a service provider that is not in your plan's network apart from in an emergency situation you will have to pay the complete expense yourself.

Premium: This is the price you pay each month for insurance coverage. Copay or coinsurance: A copay is a flat cost, such as $15, that you pay when you get care.

Documentation included. There's little to no paperwork with an EPO. A POS strategy blends attributes of an HMO with a PPO. With POS strategy, you may have: Even more flexibility to choose your wellness care providers than you would certainly in an HMOA moderate quantity of paperwork if you see out-of-network providers, A medical care physician that coordinates your treatment as well as that refers you to experts, What doctors you can see.

The Single Strategy To Use For Paul B Insurance Medicare Explained

You can see out-of-network doctors, but you'll pay more. Costs: This is the cost you pay every month for insurance coverage. Insurance deductible: Your plan may need you to pay the quantity of a deductible before it covers care past preventive solutions. You might pay a greater insurance deductible if you see an out-of-network provider.

You send a case to your POS strategy to pay you back. If you are under the age of 30 you can acquire a disastrous wellness plan.